Market Review 2025:

US Stocks Ride Rocky Road to a Third Straight Year of Gains

Index Returns 2025:

Equity and Fixed Income index market returns and index-based premiums as of the most recent quarter end.

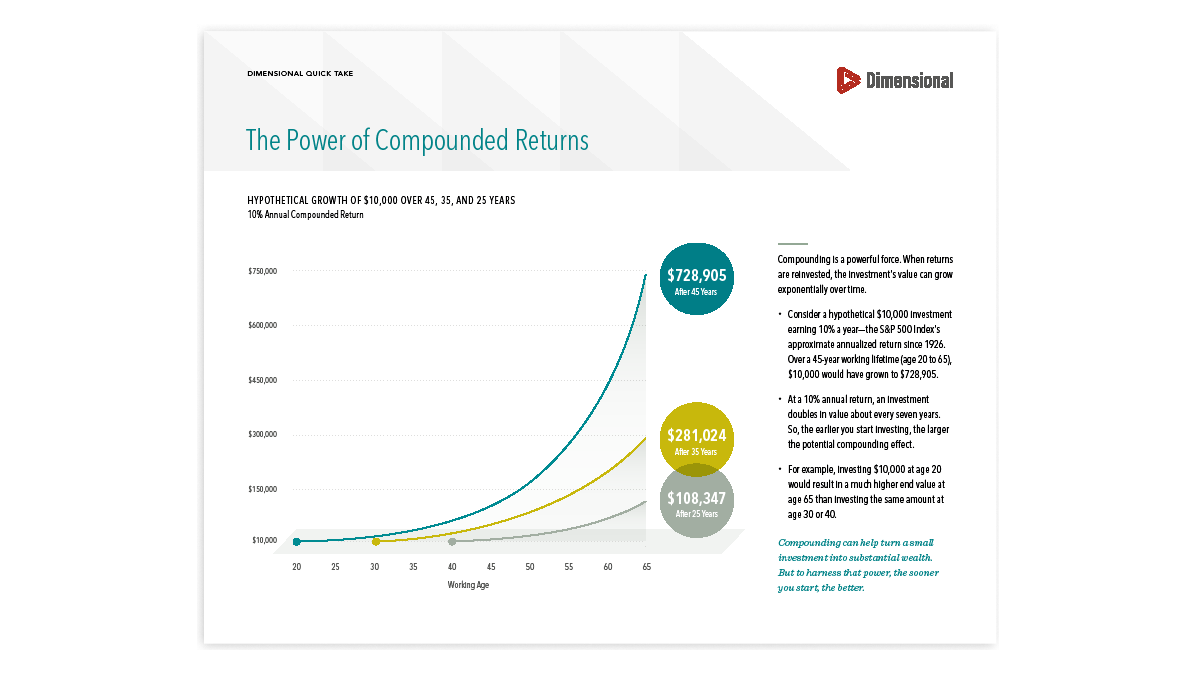

Power Of Compounded Returns

Compounding is a powerful force. When returns are reinvested, the investment’s value can grow exponentially over time.

Fiduciary Investment Management

We consider real investing to be a form of disciplined investing, where discipline is applied to your goals rather than committing to an investment, regardless of market conditions. A simple “buy and hold” strategy may effectively lower trading costs, but expanding and improving on that cost advantage is possible. Once we’ve quantified our financial goals, it becomes easier to manage strategies, as we know our destination and the growth rate required to reach it. From there, it’s a matter of taking advantage of the market's natural process of rewarding investors for risk-taking, which involves constructing a well-diversified portfolio and having the discipline to reap the expected benefits. Taking advantage of the market’s historical process of rewarding long-term discipline is best accomplished through low-cost, well-diversified, and tax-efficient mutual funds.

(925) 484-1671

anthony@carrwealth.com

Anthony Carr’s Recent Blogs on Investment Topics:

Common Questions About Social Security

A few common questions about critical aspects of Social Security and its role in a comprehensive retirement plan.

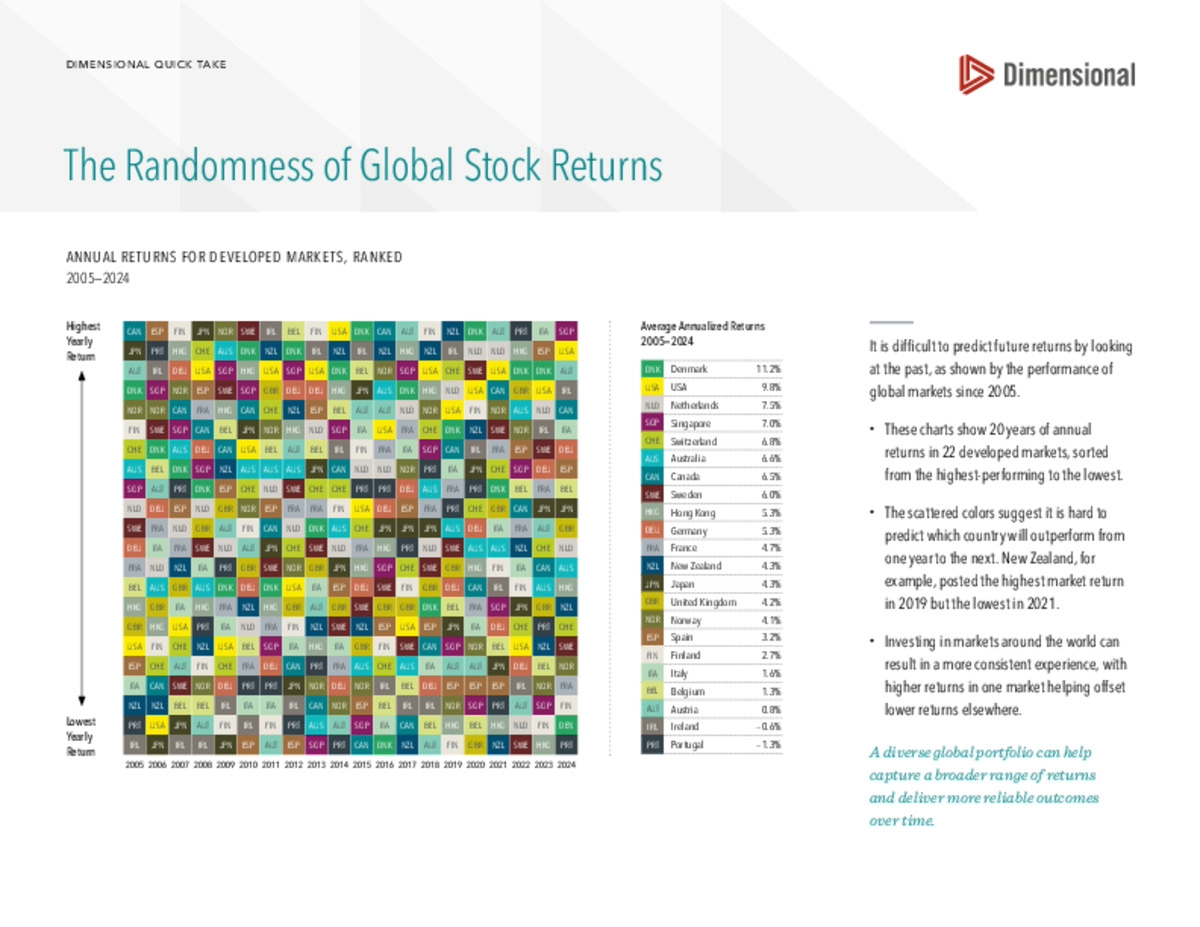

Does Your Portfolio Neglect International Stocks?

Investors diversifying outside of their home country can potentially capture these return premiums more reliably. With a well-structured, globally diversified portfolio, investors are better positioned to capture country market performance whenever and wherever it occurs.

Beneficiary IRAs - What To Know

The rules for beneficiaries inheriting IRAs can be complicated, and if not followed correctly, there can be unwanted tax consequences (income and penalties).

Don’t Be Confused Between Investing and Speculating

Speculation is a zero-sum game - a winner and a loser. Investing is about achieving market returns that have historically materialized over the long term based on an investor’s risk tolerance.

To Dividend Or Not To Dividend

A dividend-paying stock can provide regular income, but does it fit your investment strategy? Do you need the income?

What Type of Investor Are You?

A look into the various common types of investment personalities, including conservative, cautious, aggressive, and disciplined. For example, a conservative investor is usually aware that expected returns will be lower when compared to riskier investments. A cautious investor does not want to lose money, but would not mind if there was a “sure thing” out there to buy.

Interest Rate Drop - How Could That Impact Investments?

The Fed’s recent interest rate reduction is a start to igniting the stagnant economy, especially the possible surge in housing activity and its domino effect on other home-construction-related industries.

A benefit for our clients we take pride in is the efficiency and urgency to rollover or transfer accounts with other brokerages and employer- sponsored plans.

Individual Retirement Accounts (IRAs)

We manage all types of Individual Retirement Accounts, including Traditional, Rollover, Beneficiary (Inherited), Roth, and Custodial IRAs. Charles Schwab Co. is the custodian of the institutional investments we utilize for our clients.

We also manage clients:

Individual Accounts - Taxable brokerage accounts that enable tax management.

Joint Accounts - Taxable joint and community property brokerage accounts.

Trust Accounts - Revocable and Irrevocable Trust accounts.

Investment Choices

Investment Choices are offered through Public exchanges such as the New York Stock Exchange, American Stock Exchange, NASDAQ, and the London Stock Exchange. Public exchanges are organized platforms that enable their participants to trade in capital market investments, such as stocks and bonds. Some benefits of using public exchanges as opposed to Private markets are:

1) Liquidity

2) Regulation

3) Transparency

4) Diversification

Mutual Funds

A mutual fund is a financial vehicle in which shareholders put their money together to invest in securities (e.g., stocks, bonds, money market instruments). A mutual fund allows individuals to diversify their investments across many different assets, which helps spread out risk and makes it easier to build wealth over the long term.

ETF’s

An ETF (exchange-traded fund) is a type of investment fund that holds a basket of assets, such as stocks, bonds, or commodities, and trades on a stock exchange like an individual stock. ETFs offer investors instant diversification, lower costs than some mutual funds, and can be bought and sold throughout the day. They are often created to track a market index (like the S&P 500) or a specific investment strategy, theme, or sector.

Money Market Funds

A money market fund is a type of low-risk mutual fund that invests in short-term, high-quality debt securities, such as those issued by governments and highly-rated corporations.

Certificates of Deposit (CDs)

A CD (Certificate of Deposit) is a savings account that pays a fixed interest rate for a set period of time (the term). CDs typically offer higher interest rates than traditional savings or checking accounts in exchange for restricting access to your funds, as withdrawing money before the maturity date usually results in a penalty.

Individual Stocks

A stock is a share of ownership (or "equity") in a company, giving the owner a claim on its assets and earnings. Companies issue stock to raise money to fund operations, growth, or new projects.

Investment Derivatives

The four major types of derivatives are Forwards, Futures, Options, and Swaps. These financial contracts derive their value from an underlying asset and serve purposes like risk hedging and speculation. These investments carry a higher risk than the average stock, but we help clients understand the associated risks and confirm that their risk tolerance aligns with their investment strategies.

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. Diversification neither assures a profit nor guarantees against loss in a declining market. There is no guarantee that strategies will be successful.

Dimensional Fund Advisors LP (DFA)

Our predominant provider of low-cost, well-diversified, and tax-efficient Mutual Funds and ETFs is Dimensional Fund Advisors LP. DFA has shared the same investment philosophy since we began managing client investments. DFA is an independent investment company that I do not receive any compensation from, nor do I pay them anything directly. Please see the following quick one page slides, videos, and information about DFA and their investment products.

Please Contact Us

Carr Wealth Management, LLC

4695 Chabot Dr.,Ste. 200

Pleasanton, CA 94566

email: anthony@carrwealth.com

FINRA CRD#281343

NO-CHARGE INITIAL CONSULTATION