CDs and Money Market Funds - They Should Be In Your Portfolio.

Recent economic data and the potentially adverse impact of government intervention (tariffs) have made projections by “experts” that we would have three to four rate cuts in 2025 seem unlikely at best. We may now see a rate increase in the next few months.

According to December 2024, economic indicators - productivity, personal income, manufacturing, and real wages increased. The unemployment rate fell. Although retail spending decreased in January, the economy continues to display resiliency. A reduction in interest rates typically occurs when the economy is experiencing negative growth and flirting with a recession (defined as two consecutive quarters of negative GDP). Proposed tariffs will raise prices for American businesses and consumers, and retaliatory tariffs on American exports will slow manufacturing, which may lead to employee lay-offs, lower income, reduced spending, and lower economic growth. The Fed may then lower rates, but rates should remain steady for now and the near to intermediate term.

Bonds are typically the primary conservative investments

Certificates of Deposit (CDs) and Money Market funds have not seriously contributed to higher returns for the past two decades because of the minuscule rates offered. However, they do provide guaranteed and low-risk investments that have served as steady buffers and effective diversification vehicles in an overall portfolio. The conservative side of a portfolio typically includes federal, state, municipal, and corporate bonds. Bonds have maturities from thirty days (US treasuries) to thirty years. The S&P Aggregate U.S. Bond Index is a weighted average of the entire bond universe. The return of the Aggregate index for the past twelve months (as of 2/15/2025) is 4.62%. The shorter-term CDs and Money Market funds yield rates close to bonds without the risk associated with longer maturities, including interest rate, credit (non-government bonds), and inflation risks.

Certificates of Deposit (CDs)

Today's yields on CDs and money market funds are similar. Rates available today (2/15/25) for different maturities:

3 month 4.42%

6 month 4.40%

12-month rate 4.25%

3-year rate 4.30%

The benefits of a CD include the ability to lock in a rate for a particular period and the insurance guarantee of accounts up to $250,000. The downside is the potential for a penalty if you withdraw funds before maturity and the opportunity cost of higher interest income available if rates suddenly rise.

Money Market Funds

Money market funds are mutual funds that invest in liquid, short-term debt securities, cash, and cash equivalents. Because various short-term investments such as treasury bills, CDs, and cash equivalents will have varying maturities, investors measure money market funds mainly by the fund’s “7-day Yield,” which indicates the return of all its securities for the prior seven days. Here are two money market funds available:

Schwab Value Advantage Money Market Fund (SWVXX)

7-day yield 4.28%, average maturity of investments = 30 days.

Vanguard Federal Money Market Fund (VMFXX)

7-day yield 4.35%, average maturity of investments = 24 days

Which is better, a CD or an MM fund?

It largely depends on the direction of interest rates. If prices increase because of tariffs or higher demand or fail to come down significantly, the Fed will keep rates constant or increase them. Since Money Market funds contain shorter-term investments, they benefit from rising rates without the need to reinvest maturing CDs.

If interest rates are expected to fall, then “locking in” higher-rate CDs with longer maturities can avoid lower rates offered by shorter-term Money Market funds. Both investments provide interest income, which is taxable in non-qualified accounts.

Why Not Both?

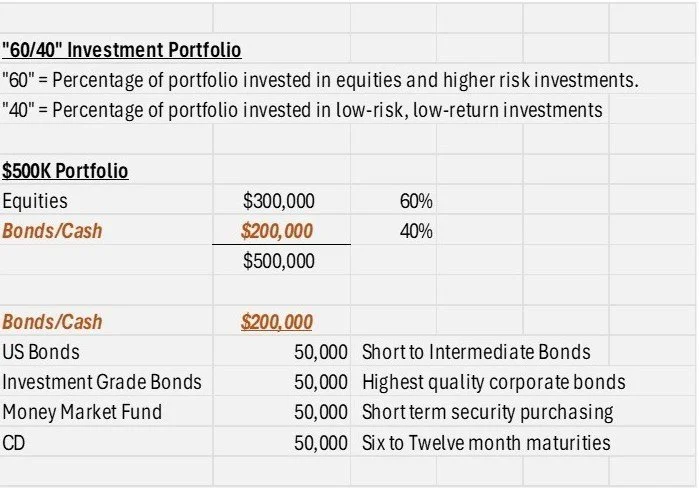

Allocating your portfolio to both CDs and Money Market funds could hedge the risks of higher or lower rates between the two. If rates increase quickly or more than expected, the MM funds will take advantage. If rates drop in the next few months, the longer-term CD (6 months and longer) will benefit. Below is an example of a “60/40” portfolio allocation with a breakdown of the conservative (40%) side:

The need for qualified financial advice is growing daily. Navigating the uncertainty of “free markets” was already challenging, let alone the possibility of a new economic system of global intrusions with tariffs and the like. Please feel free to call us at (925) 484-1671 or email me at anthony@carrwealth.com to schedule a no-charge consultation to discuss your goals and concerns.

Anthony B. Carr, CPA, CFP®, MBA

RISKS

Investments involve risks. The return and principal value of an investment may fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. Diversification neither assures a profit nor guarantees against loss in a declining market. There is no guarantee that strategies will be successful.